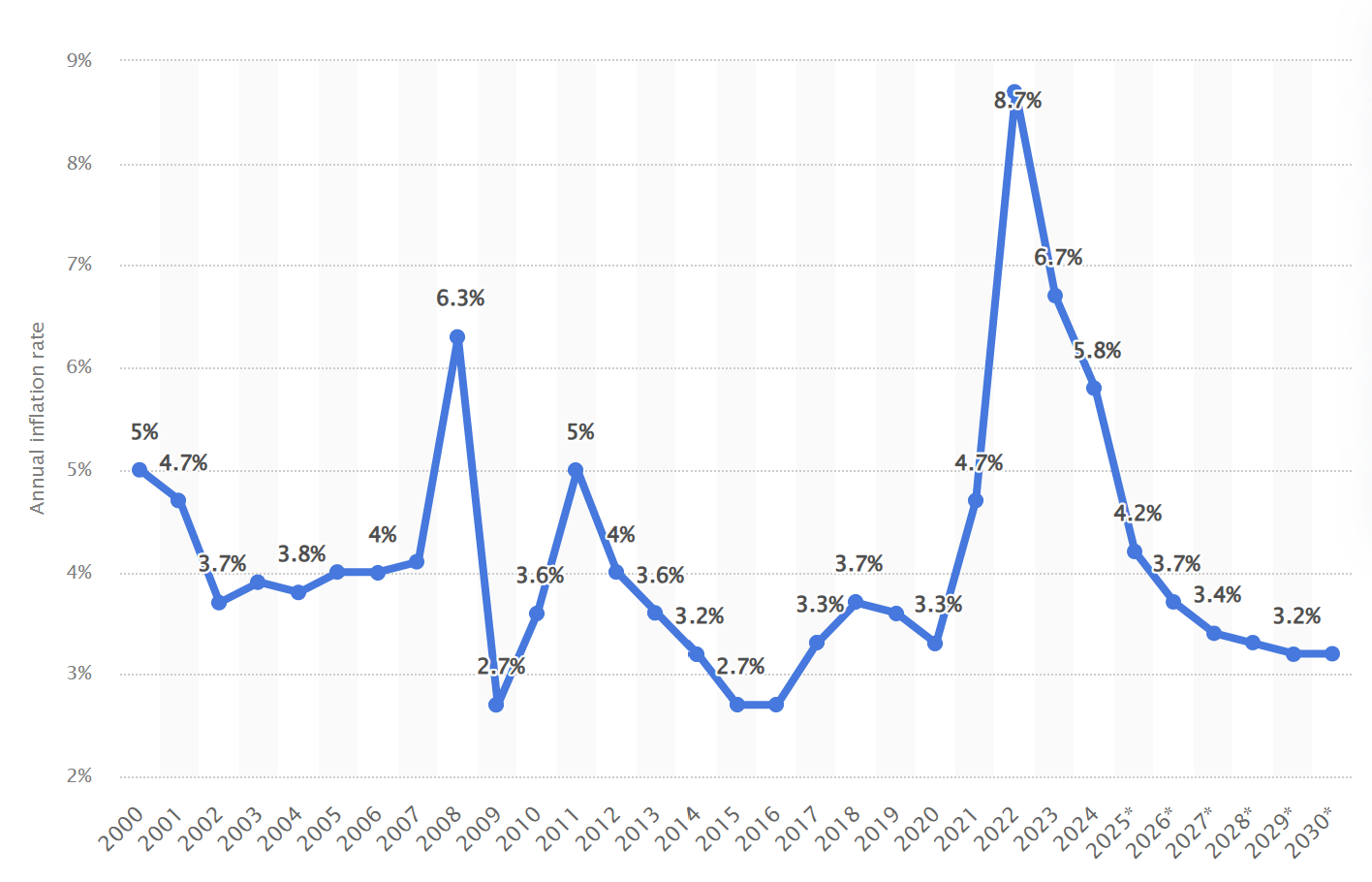

When costs rise faster than prices, “working harder” just squeezes you tighter. That’s exactly where much of print has been sitting in recent years. And while global inflation has dropped from its 2022 peak, rising costs continue to pose a significant challenge to printers.

Less than a quarter of print companies report pre-tax profit

A recent State of the Industry report, published by Alliance Insights (previously known as NAPCO Research), has highlighted the uphill battle operators across the sector face.

Through the first three quarters of 2025, average sales were up just 0.6%, while operating-cost inflation (4.4%) outpaced price rises (2.6%). Real, inflation-adjusted sales fell 2.0%, and only 23.8% of firms reported higher pre-tax profit, according to Alliance Insights.

The external pressure isn’t letting up either. 90% of those surveyed said tariffs had affected them this year – pushing operating costs up (65%), squeezing margins (49.5%), and disrupting supply chains (38.8%).

As a result more than half (52%) have delayed or may delay capex due to current uncertainty.

However, innovative leaders already know where the relief lives. Heading into 2026, the most-cited business priorities are productivity (76.7%), cost control (74.8%), and automation (61.2%), alongside quality and customer experience.

So what does this mean in practice? In short, it means removing touches, shortening lead times, and making it easier for customers to say “yes”.

In this blog, we discuss the pressures and trends discussed by Alliance Insights impacting the market and how you can improve your profit margin by combining web-to-print, workflow automation, and applied AI.

AI and automation is the key to healthier profit margins

AI and autromation have become watchwords for print and manufacturing in recent years.

Through both the technology and printing partners we have worked with over the last decade, it’s clear that there are three key drivers of profit:

- A modern web-to-print front end that captures orders cleanly, standardizes specs, and shifts low-value service to self-serve.

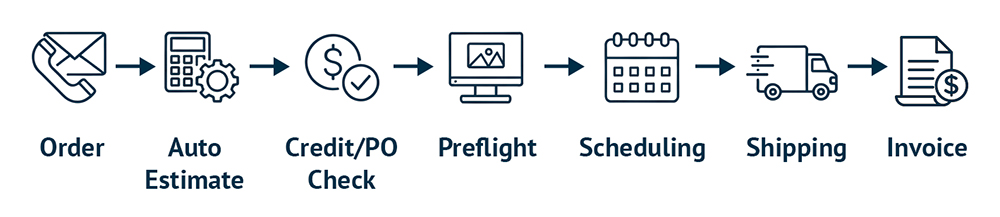

- A connected quote-to-cash workflow that routes jobs automatically from storefront to MIS/ERP, prepress, press/finishing, dispatch and invoice.

- Practical AI for the gnarly bits: extracting specs, forecasting, scheduling, visual QC, and accelerating content and customer comms.

Investment intent supports this direction. According to Alliance Insights, 63% of printers said they plan to invest in the next 12 months; across segments, e-commerce solutions, workflow software, AI applications, and digital infrastructure rank among the most-desired expenditures with company-wide productivity being the highest priority (78.3%).

Lever 1: Web-to-print: the zero-touch front end

Think of a modern platform not as “a shop” but as the polite bouncer at the door of your factory: it checks IDs (logins/roles), enforces rules (templates/pricing/approvals), and only lets clean, production-ready orders through.

What good looks like

- Branded storefronts & private B2B portals with role-based access, SSO, catalogue rules and contract pricing.

- On-brand templates & Variable Data Printing (VDP) that lock design elements but allow safe edits/versions.

- Live shipping, tax, PO invoicing and payments to reduce back-and-forth.

- Artwork upload with instant preflight, automated job tickets and barcode generation.

- Status, proofs and reorders without emails.

- Open APIs/webhooks into MIS/ERP/RIP, and routing to finishing/3PL.

Why it matters to margins

- Lower cost-to-serve: fewer emails/quotes/changes; customer self-service for reorders.

- Faster “yes”: standardized products and instant pricing lift conversion and shrink quote-to-order time.

- Fewer errors and reruns: template controls + preflight catch problems before they’re expensive.

- Stickier revenue: once a client’s ordering hub is live, repeatable work flows with less human time.

And buyers want it. E-commerce solutions are a top investment desire in wide-format (45.9%) and apparel (52.1%), with workflow software close behind. Which is why an increasing number of printers are prioritizing the portal.

Lever 2: Connect quote-to-cash: from islands to a pipeline

Most margin leakages hide in the hand-offs. Which is where automation, with a rules-driven pipeline is proving to be the perfect plug:

Where to automate first:

- Auto-estimating from product rules; for unstructured requests, use AI to extract specs from emails and map to SKUs.

- Data plumbing: push orders and specs into MIS/ERP; auto-generate job tickets, barcodes and work-to-lists.

- Scheduling: allocate by machine/shift constraints; surface exceptions only (stock-outs, rush jobs, proof issues).

- Quality gates: colour standards, prepress checks and sign-offs logged once, visible everywhere.

- Dispatch & billing: shipping labels, ASN and invoice from the same data spine.

Which is why automation sits in the top three priorities for 2026, and providers are explicitly targeting productivity and throughput.

Lever 3: AI that pays now (not later)

AI adoption has moved well past the dabbling stage. According to Alliance Insights AI Adoption in the Printing Industry report, more than two-thirds of print providers already use AI in some form, (and have done for an average of 1.5 years), though only 7% have a formal roadmap.

Crucially, 85% agree AI is critical to staying competitive.

Where are top print providers focusing their efforts?

- Generative design/copy (57%) and marketing personalisation (38%) to accelerate content and campaigns.

- Customer support (26%) and sales admin/lead scoring (23%) to reduce overhead.

- Job scheduling/workflow optimisation (21%), production automation (16%), visual quality inspection (11%), predictive maintenance (10%) for operational lift.

What they’re getting back

- Increased production efficiency (reported by 39%)

- Improved quality/consistency (33%)

- Freed staff from repetitive tasks (30%)

- Plus better sales/marketing and better customer experience (25% each) and cost savings (22%). Only 19% report “no noticeable benefits yet”.

Serious examples of compounding, real-world gains.

“Fail to plan, plan to fail”

So why are there differing levels of success, when it comes to AI implementation. The simple answer is: firms with a roadmap and clear ownership outperform when it comes to successful adoption. Which is something we have also witnessed ourselves over the last decade.

According to Alliance Insights, of the print AI “leaders” surveyed, 46% have a roadmap (vs 9% of laggards) and 91% assign accountability. Leaders also verify all AI functions far more often, and 0% report “no oversight” (vs 23% of laggards).

Unsurprisingly, leaders report more benefits and fewer “no benefits yet”.

Reskilling vs redundancy

It’s a common concern among staff that AI is here to replace them. However, print leaders are pragmatic about workforce impact: 63% disagree that AI will reduce staffing; 87% say AI skills are desirable, but an identical 87% are not actively hiring for them.

Therefore the opportunity is upskilling your current team. And with 76% agreeing transparency with clients about AI use is important, this should be built into your brand standards and SOWs.

Overcoming the adoption blockers

The biggest hurdles are human, not financial: lack of in-house expertise (57%), defining the right use cases (56%), and integration with existing systems (44%). Cost is relatively minor (11%).

Treat AI like any other change programme: pick a clear pain point, name an owner, and wire it to your workflow, don’t strand it as a side project.

A simple playbook works:

- Start small, where pain is high (estimating, invoice matching, email-to-quote).

- Assign accountability across the line—production, prepress, service—not just IT.

- Add guardrails: accuracy reviews, security, and an audit trail for decisions.

- Train and coach: 30-minute modules, vendor tutorials, brown-bag demos.

- Scale deliberately into prepress and scheduling once the front-end wins are banked. That pattern mirrors how leaders do it—and why they’re seeing more benefits.

How a modern web-to-print platform answers the brief

Without naming names, here’s how the right platform helps you hit those priorities:

- Self-service portals reduce cost-to-serve. Customers configure, price and proof online; your team handles exceptions, not keystrokes.

- Template governance & VDP protect brand integrity and speed versioned campaigns; especially for distributed brands and franchises.

- Automated estimating & rules-based pricing (including rush/complexity premiums) shorten quote-to-order and improve price realisation.

- Real-time preflight & imposition cuts spoilage and rework; paired with barcode-driven tracking, it reduces WIP uncertainty.

- Tight MIS/ERP/RIP integrations unite order, production and billing data—so invoicing happens on time and with fewer queries.

- AI add-ons extract specs from unstructured emails, auto-tag artwork, suggest schedules, or run visual QC against golden samples.

- Customer experience features (status pages, approvals, order history and instant reorders) lift retention and lifetime value.

This is exactly where capital is already pointing (e-commerce, workflow and AI) and why productivity is the number-one investment objective.

Show your workings: stacking to five points (illustrative model)

Your mileage will vary, but here’s a conservative, directional way the gains compound on a typical mix:

- –1.0 to –2.0 pts from lowering cost-to-serve (fewer manual quotes, emails, and artwork changes via self-serve portals).

- –1.5 to –2.0 pts from error/spoilage reduction (template controls, automated preflight/imposition, logged approvals).

- –0.5 to –1.0 pts from throughput (capacity utilisation rises when scheduling and makeready shrink).

- +0.5 to +1.0 pts from price realisation & mix (rule-based pricing on urgent/complex jobs + incremental VDP/personalized orders you can profitably accept).

You don’t need every lever to hit; you need enough of them to move from “survival margin” to “funded growth”. (Use your own baselines and track weekly to validate.)

A 90-day action plan you can start tomorrow

Weeks 1–2: Pick the clean win.

Choose one tightly-defined product (e.g., business cards, roll-ups, basic labels). Build the storefront product rules, templates, and approval flow. Define success metrics: touches per order, quote-to-order time, error rate, on-time-in-full.

Weeks 3–6: Connect the pipe.

Integrate storefront → MIS/ERP → prepress/RIP. Auto-generate job tickets and barcodes. Turn on payments or PO capture. Add shipping integrations. Put a pilot customer live.

Weeks 7–10: Automate prepress & QA.

Enable instant preflight and auto-imposition. Lock colour standards. Add a tracked proof-approval step. Move common press presets into the workflow.

Weeks 11–13: Add practical AI.

Start with low-risk, high-impact: email-to-estimate spec extraction; schedule suggestions; marketing personalisation to drive portal adoption. Add review/oversight steps so the team trusts the outputs. Most printers are already doing some of this; more than two-thirds report AI use, and benefits such as efficiency (39%) and quality (33%) are common.)

Measure relentlessly.

Ship with a dashboard: touches/order, quote-to-order time, makeready minutes, spoilage %, jobs/shift, margin per job. Celebrate wins; retire wasteful steps; roll to the next SKU group.

Get an expert opinion

Industry pressures, competitive forces, and runaway inflation have all eroded profit margins in the print industry. Manual processes, that allowed you to “get by”, just a few years ago no longer provide the efficiency your business needs.

By adopting AI and automation, you can reduce manual touchpoints, increase productivity and efficiency and enable your print operation to thrive again.